Table Of Content

- The Bottom Line On Buying A House

- A home inspection is essential

- How long does the process of buying a house take?

- A Realtor.com coordinator will connect you with a local agent in minutes

- Get preapproved for a mortgage

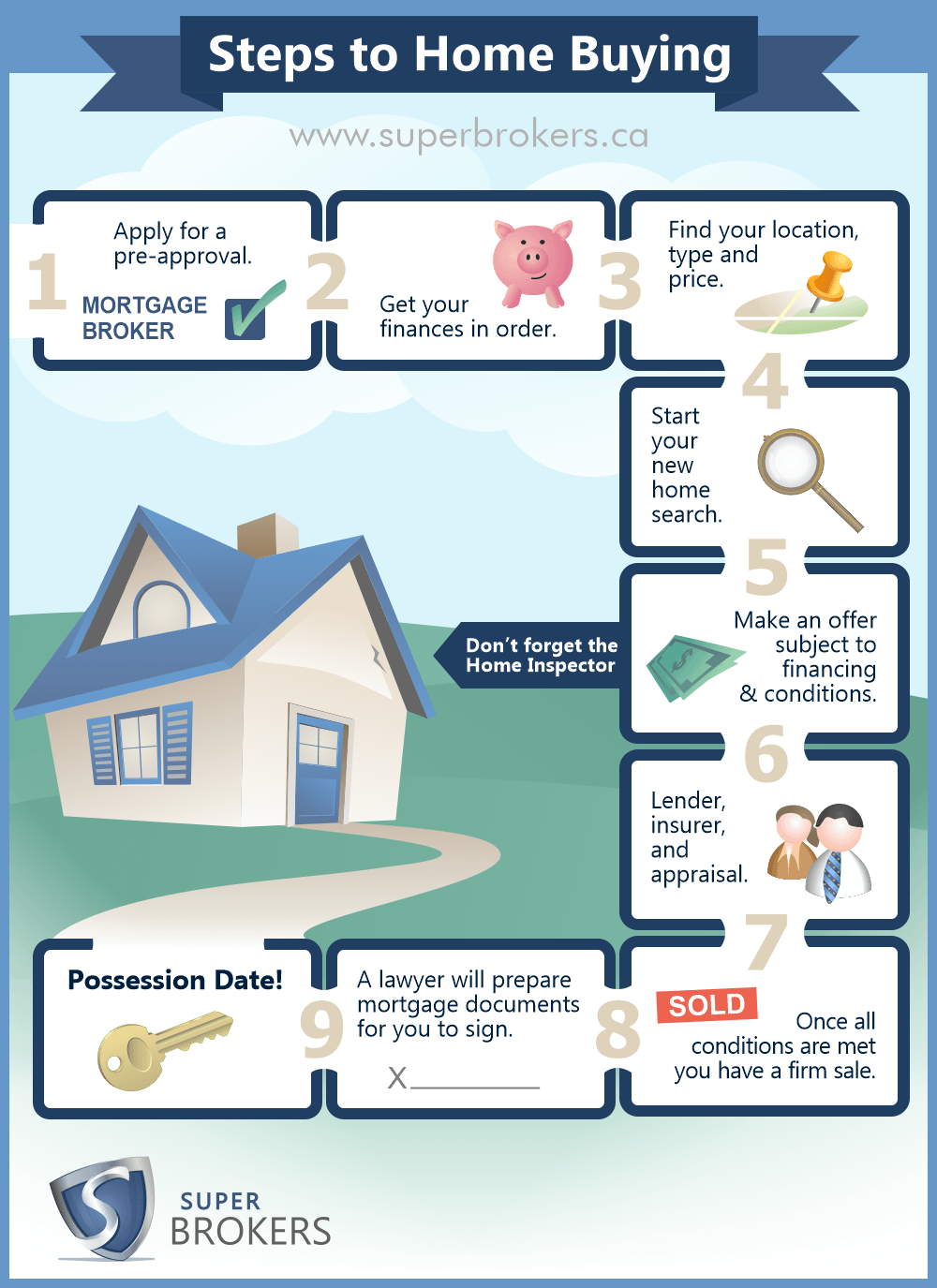

- How to buy a house? Follow these steps to buying a house for the first time

- How the House Voted on Foreign Aid to Ukraine, Israel and Taiwan

- Step 3: Save For A Down Payment And Closing Costs

The third-party contributors are not employed by Fidelity, and have not received compensation for their services. If your offer is accepted, a contract will be drawn up and then you can move on to getting a mortgage, appraisal, and inspection. You might be able to include a contingency in your contract that allows you to withdraw if issues come up during the inspection.

The Bottom Line On Buying A House

Please review its terms, privacy and security policies to see how they apply to you. Chase isn’t responsible for (and doesn't provide) any products, services or content at this third-party site or app, except for products and services that explicitly carry the Chase name. Make a mortgage payment, get info on your escrow, submit an insurance claim, request a payoff quote or sign in to your account. Go to Chase home equity services to manage your home equity account. Since the sheer number of homes can become overwhelming, it’s best to separate your must-haves from those features you’d like, but don’t really need.

A home inspection is essential

Your credit score will help you determine your financing options; lenders use it (among other factors) to set the terms and rates of your loan. The higher your score, the lower the interest rate you will be eligible for — lower scores equate to more expensive mortgages. Before they even meet with a lender, one step home buyers can take to begin understanding what they can afford as a monthly mortgage payment is to plug their info into an online home affordability calculator. This will calculate the maximum amount you can afford as a monthly payment. When you decide to make an offer on a home, you must submit an offer letter. Your agent will almost always write the offer letter on your behalf, but you can write it yourself if you choose.

How long does the process of buying a house take?

Before meeting with a mortgage lender, use an online mortgage affordability calculator to estimate how much house you can afford. Once you know what your home purchase price range will be, you can then gauge how much to save for your down payment and closing costs. There are a few basic steps you can take to boost your chances of approval for a home loan. One is to reduce your debt-to-income ratio by paying down structured debts, like car loans, and limiting your credit card usage. Putting down more cash upfront makes you less of a risk in lenders' eyes. Working to build up your credit score can help, too, both with qualifying for a home loan and getting a better rate.

The time you’ll need to find your dream home depends on the housing market in your area. However, closing on a home takes an average of 45 to 60 days once you are under contract. Closing can take even longer when negotiations and counter offers are involved, and sometimes closing will take less than 45 days when both the buyer and seller are motivated for a speedy sale. Unless you put at least 20% down on a conventional loan, you’ll likely need to pay for private mortgage insurance (PMI). This coverage protects the lender in case you default on your mortgage.

The DTI ratio is calculated by summing up all of your monthly debt payments and dividing that figure by your gross monthly income. There are also down payment assistance programs (DPAs) in every state. These offer grants or loans to qualified homebuyers who need help with their down payments.

How People Are Affording To Buy A House In 2023 - BuzzFeed

How People Are Affording To Buy A House In 2023.

Posted: Fri, 29 Sep 2023 07:00:00 GMT [source]

A home appraisal is a review that gives the current value of the property you want to buy. You will typically need an appraisal before buying a home with a mortgage loan. The amount you’ll need for a down payment depends on your loan type and how much you borrow. If a down payment is required, you can buy a home with as little as 3% down (although putting down more has benefits).

If you have an inspection contingency in your offer letter, you can walk away from the sale and keep your earnest money deposit. Doing your own research rather than going with who your lender or real estate agent recommends for title insurance, an inspection, and more could help further cut costs. Jake Hill, 38, shopped around when he purchased his home in Austin, Texas, in 2018. "It was tempting to take the easy route and just go with the defaults," says the CEO of DebtHammer. But Hill requested a list of available closing service providers in the area, which lenders are required to provide. "I'd estimate I saved about $2,000 between closing and title insurance," he says.

Step 3: Save For A Down Payment And Closing Costs

Before you shop for properties and compare mortgage options, you’ll need to make sure you’re ready to be a homeowner. For clothing, you don’t actually need to be making full-on clothes. Really, all you need to supply is the ingredients, and the quickest (and cheapest) way to do that is with leather. A hunting camp generates hides while also producing meat for food, so that’s your best option. Backyard goat sheds also generate some hides, but the setup costs 25 Regional Wealth, so it’s better to wait.

To lower your DTI ratio, pay off as much debt as possible before applying for a mortgage. This includes credit cards, auto loans, student loans, and other loans. There's a wide array of lenders to consider, including traditional banks, online non-bank lenders and credit unions. Once you find the right home, your real estate agent will also help you submit an offer, and potentially begin negotiating with the seller. Once the seller accepts your offer, it’s time to move to the final stages of the home buying process.

For the rooftiles, you’ll need a mining pit (1 timber) over a clay deposit and a clay furnace (2 timber, 5 stone). On top of it all, you’ll need to assign families to each of those tasks (you don’t need to assign a family to the church). With a vegetable garden (see above), you’ll get some food, but you’ll need to supplement it with a hunting camp (no construction cost) and a forager hut (1 timber). Now that the US House of Representatives, acting in an unusually bipartisan way, has finally passed a $61 billion aid package for Ukraine, the big question is what the Ukrainians should spend it on.

Martin Orefice, 41, benefited from one of those programs when he bought his Orlando home. "I got $20,000 for a down payment, and it was not a loan that I had to pay back," says the CEO of Rent to Own Labs. Here are some programs that could get you to homeownership sooner. We offer a variety of mortgages for buying a new home or refinancing your existing one. Our Learning Center provides easy-to-use mortgage calculators, educational articles and more.

And that means, for example, even if you pause the work at a Tailor’s Shop, the family won’t become unassigned and available for other jobs. And, to make sure nothing rots or gets ruined by the weather, you’ll need a granary (2 timber, 10 stone) and a storehouse (2 timber). To turn that timber into planks, you’ll need a sawpit (2 timber) that will turn 1 timber into 5 planks.

Just because a bank says it will lend you $300,000 doesn’t mean that you should actually borrow that much. You may also be able to take advantage of down payment assistance or closing cost assistance programs as a first-time buyer. Your lender will send over a closing disclosure, which details how much money you need to bring—typically in the form of a bank check—as well as details of your loan and monthly payments. If you're a first-time home buyer, many cities and states offer programs or financial assistance for qualified households as an incentive to put down roots in the area.

No comments:

Post a Comment